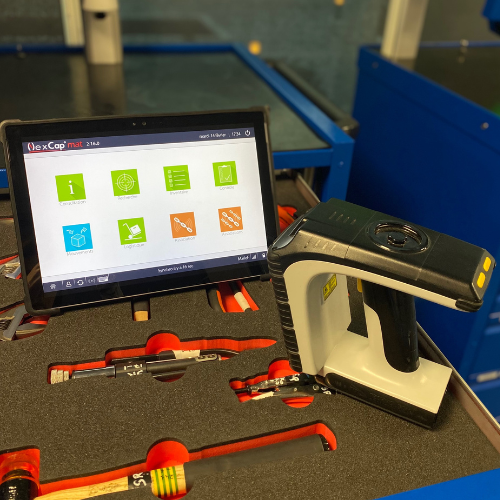

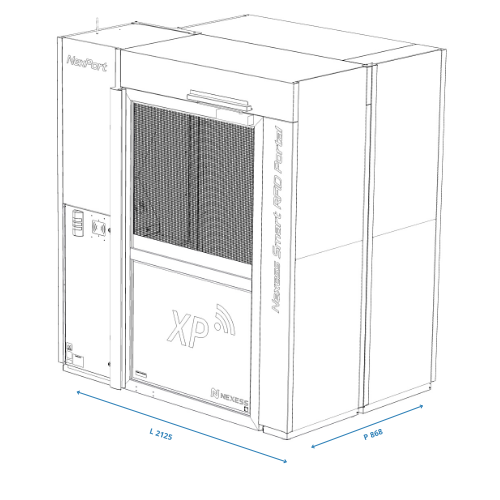

Our self-inventorying & connected XL RFID smart cabinets

Our XL RFID smart cabinets ensure detection and traceability of all types of industrial equipment, from hand tools, requiring calibration, to the smallest tools. Each operation is tracked via an automated real-time inventory, ensuring 100% traceability for up to 400 RFID assets*. This inventory is connected to the Information System, and can therefore be accessed remotely.

Our smart RFID cabinets are modular and adaptable to the desired configuration in terms of shelf type (inclined/straight/sliding) and positioning in the cabinet.

Audio and visual alerts inform users in the event of an anomaly (tools stored at the wrong location, calibration date approaching or exceeded, loan duration exceeded, etc.).

Fitted with 4 electrical sockets, the smart cabinets are able to recharge portable electrical devices during storage.

* Subject to compliance with RFID tagging and layout processes.

Français

Français